DFIA

Home / Our Services / DFIA

DFIA is issued to allow duty free import of inputs, fuel, oil, energy sources, catalyst which are required for production of export product. The Authorization shall be issued on the norms of inputs and export items given under the Standard Input and Output Norms (SION). Thus, the import entitlement must be limited to the quantity mentioned in SION. The finer details of DFIA scheme are explained under the Foreign Trade Policy of India 2015-2020.

Exemptions under DFIA –

- Only the payment of basic customs duty (BCD) is exempted under the Duty-Free Import Authorization scheme.

- IGST and compensation Cess are not exempted under the DFIA scheme.

Eligibility for obtaining the benefit-

- Duty Free Import Authorization shall be issued on post export basis for products for which Standard Input Output Norms have been notified.

- Merchant Exporter shall be required to mention name and address of supporting manufacturer of the export product on the export document viz. Shipping Bill / Airway Bill / Bill of Export / ARE-1 / ARE-3.

- Application is to be filed with concerned Regional Authority before effecting export under Duty Free Import Authorization.

Minimum Value Addition Clause-

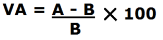

Value Addition shall be:

Where,

A = FOB value of export realized or the FOR value of supply received.

B = CIF value of inputs covered by the authorization, plus the value of any other input used on which benefit of DBK is claimed or intended to be claimed.

- The minimum Value addition required to achieved is 20% under DFIA License.

These authorizations are issued in the form of scrips by the DGFT. The scrips are transferable and tradable in the open market. Minu International is one of the oldest and largest traders of DFIA scrips in the market. We also undertake the paperwork for filing applications for the same. If you are a garment or fabric exporter, do give us a call to talk more about how you can avail this benefit for your business.